What Dealmakers Need to Know About CFIUS and Semiconductors

From 2019 to 2021, Tyler McGaughey, a partner in Winston & Strawn LLP’s Washington office, served as the Deputy Assistant Secretary (DAS) for Investment Security at the U.S. Department of the Treasury, where he was responsible for supervising the day-to-day operations of Treasury’s Committee on Foreign Investment in the United States (CFIUS, or the Committee) team. During his tenure, Tyler supervised the completion of national security reviews and investigations for hundreds of transactions, including semiconductor transactions. In this briefing, Tyler lists his 17 things that dealmakers need to know about CFIUS and semiconductors.

1. CFIUS is heavily focused on semiconductors. If CFIUS were to make a list of the technologies that it considers most important for national security, semiconductors would likely be at the very top. CFIUS recognizes that semiconductors play a crucial role in many types of critical and emerging technologies with military applications. For CFIUS, protecting whatever technological advantage the United States still has in semiconductors is a national security imperative.

2. CFIUS’s focus is not just on U.S. semiconductor companies that supply chips to the military. CFIUS is focused on all types of U.S. semiconductor companies, including companies that make chips for personal computers, cellular telephones, automobiles, and other consumer electronics. The intellectual property (IP) and know-how needed to design and manufacture cutting edge chips for the newest luxury vehicle or 5G cellular telephone can also be used to make chips for items with more direct national security applications.

3. It is incredibly challenging for foreign companies to obtain CFIUS approval to acquire U.S. semiconductor companies. Even non-Chinese investors are heavily scrutinized when it comes to semiconductor transactions.

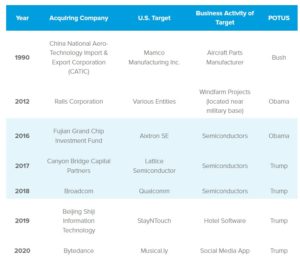

4. Presidents have blocked several semiconductor transactions. Presidents have used their CFIUS authority to block transactions only seven times since 1988. Three of the seven blocks involved semiconductor transactions, and all three of those blocks occurred within the past five years or so.

5. But Presidential blocks do not tell the whole story. In most cases, when the Committee identifies a national security risk and informs the parties that it intends to refer the matter to the President, the parties abandon the transaction voluntarily. In other words, lots of cases never reach the President because the parties know that the President will likely block the transaction, so they simply walk away from the deal before that happens. Significantly more transactions are abandoned each year than are blocked by the President. For example, in 2018, transaction parties voluntarily abandoned 18 transactions after being informed by the Committee that it was unable to identify mitigation measures that would resolve its national security concerns or after it proposed mitigation measures that the parties chose not to accept. In 2019, the number of transactions voluntarily abandoned was eight. Even though Presidents have only blocked three semiconductor transactions since 1988, more have been voluntarily abandoned, particularly in recent years.

6. CFIUS has jurisdiction over almost any type of transaction where a foreign company invests in a U.S. semiconductor company. Historically, CFIUS has had jurisdiction over investments where a foreign company acquires a controlling stake in a U.S. business. Congress recently passed a new statute expanding CFIUS’s jurisdiction to include certain non-controlling investments. Even if a foreign company does not make a controlling investment in a U.S. semiconductor company, this new jurisdiction will likely apply. Thus, unless a foreign company is making a purely passive investment, any equity investment in a U.S. semiconductor company will likely trigger CFIUS jurisdiction.

7. Semiconductor transactions are the type of transactions where the Committee is more likely to be (very) aggressive asserting jurisdiction. If there is a type of transaction that will make the Committee stretch its legal authorities as far as possible to find jurisdiction, it is a semiconductor transaction. In 2016, President Obama issued an order blocking a Chinese investment fund from purchasing Aixtron, a German semiconductor company. More recently, on June 15, 2021, CFIUS issued an interim order prohibiting a Chinese private equity firm from acquiring Magnachip Semiconductor Corporation, a South Korean semiconductor company.[4] In both cases, the target company may not have appeared to be a U.S. business, but CFIUS still managed to find a basis to assert jurisdiction.

8. Even investments in U.S. semiconductor companies made by U.S. fund sponsors may fall within CFIUS’s jurisdiction. If a private equity fund has foreign limited partners (LPs), CFIUS will want to review the partnership agreement. If foreign LPs have no control rights or covered investment rights, then CFIUS will likely not have jurisdiction over the fund’s investment in a U.S. semiconductor company. But Treasury’s Office of General Counsel (OGC) reviews governance documents carefully and with an eye towards finding jurisdiction. Moreover, Treasury OGC takes the position that control rights (and covered investment rights) are effectively binary—you either have control or you do not. In other words, there is no such thing as having only a little control. If Treasury OGC identifies one control right or covered investment right, it will likely conclude that CFIUS has jurisdiction over the investment.[6] Accordingly, if a U.S. fund sponsor intends to raise capital from foreign LPs and invest in emerging and critical technologies, including semiconductor companies, the fund sponsor should carefully review the LP rights in the partnership agreement (and any other side agreements) to ensure that the fund does not unintentionally expose itself to CFIUS jurisdiction.

9. The CFIUS process for semiconductor transactions is often longer and more onerous than for other types of transactions. CFIUS conducts due diligence on transactions by sending written questions to the parties, which they are legally required to answer. For semiconductor transactions, the Committee typically asks numerous questions, and it continues to ask questions until the very end of the review process. In addition, semiconductor transactions often require the parties to attend meetings with the Committee. In some cases, meetings may include senior executives from the transaction parties and senior government officials from the Committee. Finally, semiconductor transactions often take longer than 90 days to complete the CFIUS review process. Ordinarily, CFIUS has 45 days to conduct a “review,” and if necessary, it has another 45 days to conduct an “investigation.” However, if a case gets close to the 90-day mark and it looks like it will take longer to finish, CFIUS asks the parties to withdraw and refile their transaction, which restarts the clock. Semiconductor transactions often involve at least one withdraw/refile, if not more, which can extend the CFIUS process far longer than 90 days.

10. Because CFIUS reviews often take longer than 90 days to complete, semiconductor transactions are not ideal candidates for the new Declarations process. Under CFIUS’s new regulations, there is a new, faster way to get CFIUS approval for a transaction. Rather than filing the normal application, transaction parties can file a shorter application called a Declaration. After the parties file a Declaration, CFIUS has only 30 days to conduct due diligence on a transaction. In many semiconductor cases, the Committee cannot complete its work within the regular 90-day time period. It is therefore highly unlikely that the Committee will complete its work within the shorter, 30-day Declaration period. When CFIUS cannot finish its assessment of a Declaration within 30 days, the Committee has the authority to request that the parties file a normal application and go through the regular 90-day process. Thus, in semiconductor cases, filing a Declaration is probably just a recipe for extending the CFIUS review process from a minimum of 90 days to a minimum of 120 days.

11. In addition, because CFIUS reviews often take longer than 90 days, U.S. semiconductor companies are probably not great targets for Special Purpose Acquisition Companies (SPACs). SPACs typically have around 18-24 months to identify and complete a merger with a target company. Depending on when the SPAC identifies the target, there may not be enough time to go through the CFIUS process, particularly if the Committee requests multiple withdraw/refiles and ultimately determines that it cannot clear the transaction unless the parties negotiate and enter into a mitigation agreement.

12. In semiconductor cases, CFIUS is primarily concerned about the risk of technology transfer. During the due diligence process, the Committee tries to determine if the U.S. semiconductor company has any IP or know-how that is better than anything currently possessed by strategic competitors. If anything is identified, the Committee assesses whether allowing the foreign entity to acquire the U.S. semiconductor company could provide an opportunity for a strategic competitor to acquire the IP or know-how, thereby reducing the technology gap between the U.S. and its strategic competitors. When assessing the risk of technology transfer, CFIUS is not focused on discrete types of semiconductor IP or know-how. Rather, CFIUS is focused on every aspect of the semiconductor supply chain. If a U.S. semiconductor company is particularly good at any aspect of designing or manufacturing semiconductors, CFIUS will want to ensure that any IP or know-how will not fall into the hands of a strategic competitor. In some cases, a U.S. semiconductor company’s IP or know-how may be so important for national security that the Committee will not permit any acquisition by a foreign entity, regardless of the home country of the foreign acquirer.

13. It can be difficult to anticipate ahead of time which products, IP, or know-how will raise technology transfer concerns with the Committee. The Committee is not concerned only about the “leading edge” of semiconductor design and manufacturing. Even older-generation products, IP, and know-how—the so-called “trailing edge”—can play an important role in U.S. national security. Thus, simply because a U.S. semiconductor company is not designing or manufacturing chips on the leading edge does not mean that the Committee will have no technology transfer concerns. Similarly, just because a foreign acquirer is widely regarded as being as advanced—or even more advanced—than the target U.S. semiconductor company does not necessarily mean that CFIUS will be okay with the transaction. The target U.S. semiconductor company may have something unique that the Committee would want to protect from falling into the hands of a strategic competitor.

14. In semiconductor cases, CFIUS is also concerned about protecting the U.S. government’s access to reliable sources of supply. During the due diligence process, CFIUS determines whether the U.S. semiconductor company supplies products to the U.S. government—in some cases, the U.S. semiconductor company may not even know that it does. If the U.S. government relies on chips from a U.S. semiconductor company, then CFIUS most likely will not permit an acquisition unless the foreign acquirer agrees to continue supplying the U.S. government for a certain period of time.

15. Transaction parties involved in semiconductor transactions should expect that they will be required to negotiate a mitigation agreement. In semiconductor cases, CFIUS often identifies a national security risk and will clear a transaction only if the parties agree to enter into mitigation. Mitigation measures for semiconductor transactions can be burdensome. A typical mitigation agreement might require the target company to implement certain safeguards, such as adding U.S. citizens to the board, hiring a security officer, and prohibiting the foreign acquirer from accessing certain IP and know-how. In supply assurance cases, the mitigation agreement may require the foreign acquirer to agree not to offshore certain assets and continue supplying the U.S. government for a certain period. Before entering the CFIUS review process, transaction parties should think carefully about how CFIUS’s standard mitigation measures would apply to their transaction and determine whether the business rationale for the transaction would still make sense if they were required to implement those mitigation measures.

16. Transaction parties in semiconductor cases cannot avoid CFIUS by simply refusing to file their transactions. As we noted in a recent client alert, the U.S. Department of the Treasury, which is the chair of the Committee, recently created a new team—called the “non-notified” team—whose only job is to scour press releases, commercial databases, bankruptcy filings, and other sources, searching for transactions that were not filed with the Committee and may have national security consequences. If the parties fail to notify the Committee of a semiconductor transaction, the non-notified team will almost certainly find it, and if it does not, another CFIUS member agency will likely find it and notify Treasury. If no CFIUS member agency finds the transaction, there are many other ways the transaction can come to CFIUS’s attention—a member of Congress may send a letter to Treasury, a reporter may publish an article, or a business competitor who lost out on the deal could provide a tip to CFIUS. Given the importance of semiconductors, especially in the current geopolitical climate, it is hard to believe that parties can conduct a semiconductor transaction of any size that will not come to CFIUS’s attention. If there is any possible basis for the Committee to assert jurisdiction over the transaction, the parties should file voluntarily.

17. The United States is not the only country focused on semiconductors. Other countries have their own CFIUS-like processes and are also focused on semiconductor transactions. For example, in late March, the Italian government blocked a Chinese acquisition of an Italian semiconductor firm.[7] Similarly, earlier this month, the UK government announced that it would review the takeover of the UK’s largest silicon wafer manufacturer by a Chinese-backed company on national security grounds.[8] Going forward, it will not matter where the target company is located. Even if the target company is not a U.S. business, the parties will likely need to negotiate some type of CFIUS-like process in the target’s home country in order to obtain regulatory approval to acquire a semiconductor company.